By Vanessa Radatus

It may not be ranked among the most dangerous profession in U.S, but recent headlines about celebrity chefs and Food Network personalities have got us thinking that being a top chef should be ranked among the riskiest jobs.

Here’s some food for thought. Just this year, celebrity chef and cooking show host, Paula Dean, reluctantly announced that she was diagnosed with type 2 diabetes. Known for her Southern-style, often deep-fried, high calorie recipes, it came as no surprise to those who watch her show.

According to experts, a chef’s lifestyle poses many safety and health risks. Not only is a busy kitchen a dangerous place in general- with sharp knives, hot pans, slippery floors and sanitation issues- but a chef must also constantly taste the food they make leading to high-caloric intake, which can cause obesity, heart disease and diabetes like Paula Deen.

We often hear about high risk jobs like firefighters, police officers, and construction workers, but what if a celebrity chef or TV food host is injured, seriously ill and can no longer perform? How does that affect his or her income? And how does it affect the overall “brand” and the businesses that rely on their name? In a

recent Risk Management article, “Chopped Chef,” they explain how insurance works for these high profile food connoisseurs.

The article lays it out pretty clearly, proving that a chef’s job is worth protecting, especially if a million dollar brand is involved: “Investors and corporate risk managers generally recognize how dependent these franchises are on the brand of their celebrity chefs. Their response is often to secure large blocks of key person life insurance to protect against an untimely death. But many often ignore the greater risk of injury and forgo disability coverage, which may be a mistake if you realize that replacing these individuals is not as easy as calling up a recruiting agency.”

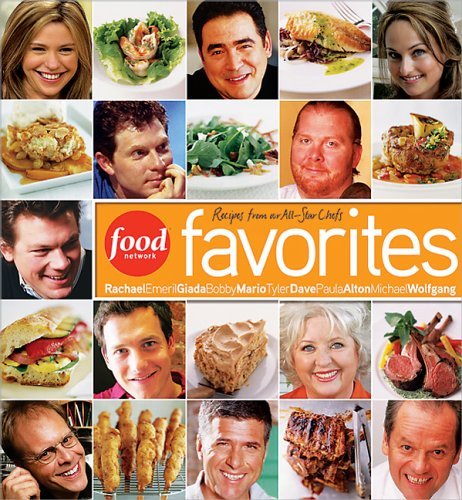

For this reason, large corporations dependent on personalities such as Martha Stewart, Gordon Ramsay, Rachel Ray, etc, procure key person life and key person disability insurance in order to protect the wide array of people invested: the company, the employees, the shareholders, the board of directors, production and merchandising partners, etc.

“Chefs also can obtain coverage as a form of personal protection. This was the case for one high-profile celebrity chef in his mid-40s who was updating his financial plan when his new wealth adviser noticed that he failed to maintain disability income protection. With an annual income north of $2 million, the chef wanted to be able to maintain his lifestyle in the event of a disability. A policy was structured with a 90-day waiting period, followed by $100,000 per month of tax-free disability benefits. Coverage was underwritten protecting losses from both accident and illness utilizing a specific occupation policy form that covered the insured if he could not be an “on-air” personality. In all, nearly $15 million of future income was protected at a cost of around $40,000 annually.” Read More…

Leave a Reply